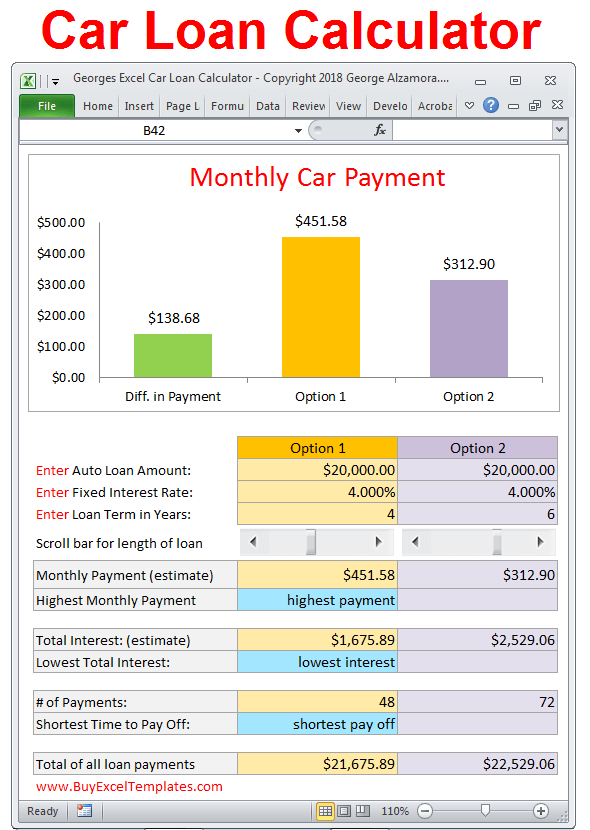

The truth is, dealers make more money when you finance, so they’re winning if they convince you to borrow more-whether that’s by extending your loan term, encouraging you to put down a smaller down payment, or selling you a pricier car if you have a larger down payment.īut what the car dealer won’t tell you is that your shiny new car will lose 60% of its value-what we call car depreciation-within the first five years! 5 Remember, the car dealership’s number one job is to convince you to finance a car (and most likely one that stretches your budget to its limit!). So, while yes, those numbers prove that financing a car is “a way of life” in America, let’s stop and think about that for a minute.ĭo you really want another monthly payment added to your plate, or do you just feel like financing is the only way to “buy” a car? Step 2: Hit Calculate to see what your monthly car payment would be.Īuto loan debt in America is now sitting at a whopping $1.37 trillion, with 81% of all vehicles being financed.

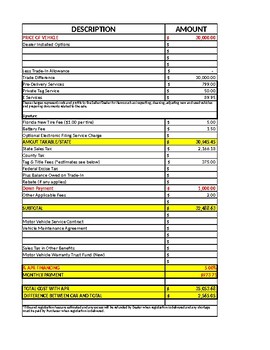

That means if your loan term is for 60 months and you never pay more than the minimum and you never miss a payment, then you’ll be done paying back that debt in 60 months, or five years ( ouch). Loan term refers to the length of time it will take to pay back the loan when you make regular payments. (Or read ahead. We’re not writing a Sherlock Holmes novel here.) Loan Term But remember, the dealership’s goal is to resell your trade-in at a higher price, so you may not get top dollar for it. The dealership will decide how much they think your car is worth to them, and then they’ll take that much off the price of the car you’re buying. If you’re buying a car from a dealership, you might choose to trade in your car instead of selling it privately. (The one-sentence summary of that article? You typically make more money off the car when you sell it privately vs. We say, why just have a lower monthly payment? Why not have no payment at all? Right, it sounds crazy. And then that lowers your monthly car payment.īut-spoiler alert-we go against the grain here. That’s because the down payment lowers how much money you’d have to borrow to “buy” the car.

The more you pay in cash up front, the lower your monthly payment will be. Down PaymentĪ down payment on a car works like a down payment on a home. Just remember-whether you’re buying a car from a dealership or a private seller, the listed price is usually negotiable. Car price refers to the amount of money you’re paying (or borrowing) for the car. Before you plug in your numbers, let’s take a look at what all the terms in the car payment calculator mean. We empower you to fully understand every decision you make with your money. And sometimes it feels like it’s designed to be that way. A lot of financial stuff can be confusing. And some of them are as confusing as why you would need scissors to open a package of scissors.īut don’t worry-it’s not just you. Some of the terms on the car payment calculator are simple.

0 kommentar(er)

0 kommentar(er)